T-Mobile Goes Deeper & Wider in 2.5GHz Holdings - FCC Auction 108 Results and Impact

Dave Yeager

S4GRU/T5GRU

Friday, September 23, 2022 - 3:20 PM PDT

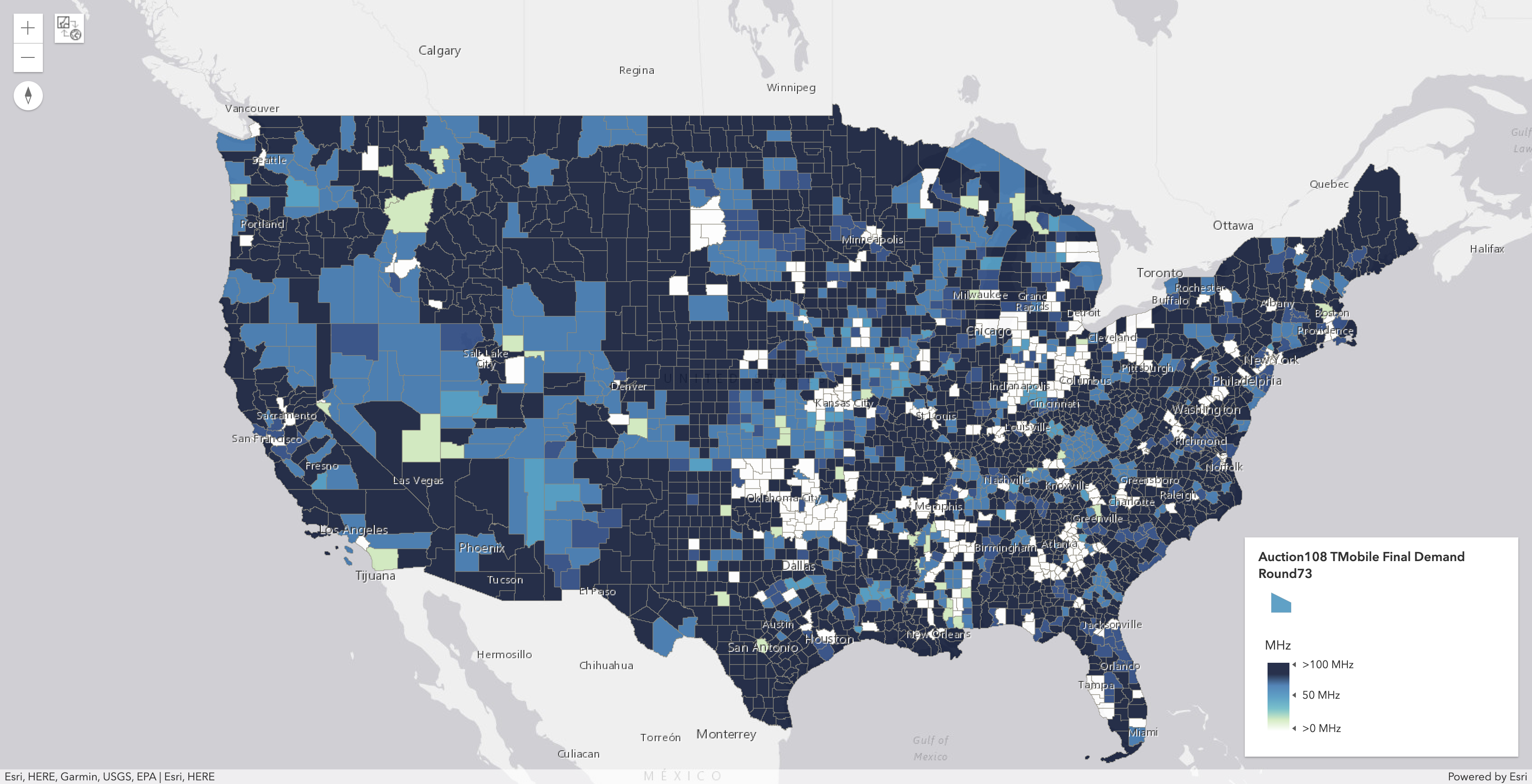

Source: www.sashajavid.com/Auction108_TMobile_Final_Demand_Round73.png Click for interactive map covering all auction areas. (May take a few minutes to fully load, PC or tablet recommended)

The very favorable FCC Auction 108 for 2.5GHz ED results shown above should allow T-Mobile to immensely expand its rural market share, currently around 13%. The merger alone dramatically increased the number of T-Mobile customers traveling through rural areas. The number of macro cell tower sites has increased from 66,000 on 12/31/2019 to a rough estimate of 88,000 sites by the end of 2022. (102,000 on 12/31/2021 minus the remaining 22,000 planned Sprint cell site decommissions by 9/30/2022 plus 10,000 sites for rural and small cities. This does not factor in co-locations, any other new sites added in 2022, or sites that have been decommissioned where T-Mobile still holds an interest -- the true number may not be available until the 2022 annual report.)

T-Mobile 5G Home Internet Service should definitely attract new rural customers, which will help make rural sites more viable. n71 lowband 5G has already made T-Mobile's rural service much more usable. n41 will offload much of that 5G traffic given its much higher capacity. Having more bandwidth will also extend the usable area of n41, which can be further extended by utilizing n71 CA to increase the upload range and performance. Combining this with T-Mobile's long announced increased rural and small town focus could be a very winning strategy that allows them to fulfill their merger promise to the FCC concerning nationwide 5G coverage of at least 50Mbps.

Drilling down into the auction results, T-Mobile recently won 7,156 2.5GHz ED licenses in 2,724 counties in FCC auction 108. That is roughly 87% of all the U.S. counties (3,143 counties or equivalents exist in the United States.) Each county license has 53% white space on average (area without existing ED licenses by frequency). Note that white space varies by smaller frequency ranges and/or can cover just a portion of the county. According to ALLnet measurements, 2,490 licenses have 90% or better white space in this latest auction.

These ED licenses typically reside in rural areas, but do include a few metro areas. Metro area counties with 25% or more white space include these metro areas: Atlanta, GA, Chicago, IL, Dallas, TX, Kansas City, MO, Los Angeles, CA, New York, NY. These counties are typically at the outside edges of these metros.

The auction timing, auction rules, and complexity of the ED band favored T-Mobile. This auction occurred after the 2021 C-Band and 3.45GHz auctions which both offered the possibility of nationwide coverage. Not much money appeared to be left for auction 108. Verizon's small bid in this auction has even been questioned as unwise.

|

$ in Millions rounded.

|

|||

|

AT&T |

$ 23,407 |

$ 9,079 |

$ 0 |

|

Verizon |

$ 45,455 |

$ 0 |

$ 2 |

|

Dish |

$ 0 |

$ 7,328 |

$ 0 |

|

T-Mobile |

$ 9,336 |

$ 2,898 |

$ 304 |

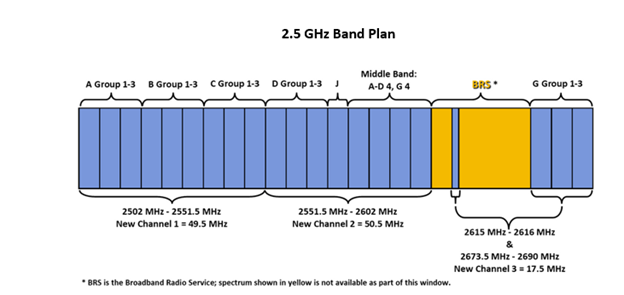

For this auction, the FCC tried to simplify ED with C1= 49.5 MHz contiguous, C2 = 50.5 MHz contiguous, and C3 = 17.5 MHz (16.5 MHz contiguous plus 1 MHz inside BRS). C3 was most attractive to T-Mobile given their BRS holdings. In addition to ED, BRS makes up the rest of 2.5GHz band 41.

Source: www.fcc.gov/sites/default/files/bandplan_for_fact_sheet.png

Prior to the auction the FCC setup a special window for tribes to obtain ED licenses. They also eliminated the educational purpose requirement of ED, but preserved the role of non-profit groups like Mobile Citizen and Mobile Beacon. They also allowed existing ED licenses to be sold rather than just leased. T-Mobile has been quite busy securing available licenses since then. It also fought for its lease details to remain secret, which other carriers opposed, but the FCC supported. The FCC sided with the smaller carriers and T-Mobile over lease size being the smaller county size rather that PEAs which are typically multi-county partial economic areas.

The original aspects of the ED and BRS licenses also discourage other carriers. They both started as radius, but then most but not all of the BRS converted to counties, while ED primarily remained radius. Where two intersect on the same frequencies, they "split the football". Some shifted frequencies, but others remained the same. The frequencies in ED are also quite small by today's standards and often not contiguous. BRS also has some licenses that appear to basically be duplicates. Band 41 also uses TD rather than FD, thus favors downloads. Basically no where near as clean as bands like PCS band 2 where all the other carriers are more comfortable.

It should be noted that not all licenses were sold, typically in Alaska and places with almost no whitespace. Note that there is also a scattering of BRS licenses that were never sold plus licenses in other auctions. Maybe the FCC should have an odds and ends auction once congress extends its auction authority which expires on September 23. It is also possible that T-Mobile may choose to lease spectrum for some of the other winners, such as the North American Catholic Education Programming Foundation, who already leases 2.5GHz spectrum to T-Mobile.

Final payments are due by September 30, 2022 (October 17th with 5% penalty.) T-Mobile upgrading existing n41 sites is a no-brainer, likely immediately after FCC release. More bandwidth first followed by greater fiber backhaul later. What avenues T-Mobile pursues after that is the question.

Here are the FCC Auction 108 2.5GHz results by license: https://auctiondata.fcc.gov/public/projects/auction108/reports/results_by_license. If you are curious about the other winning bidders: https://docs.fcc.gov/public/attachments/DA-22-910A2.pdf. Further overall analysis by bidder is available here: https://www.sashajavid.com/FCC_Auction108.php#county_details_table_overlay.

-

8

8

-

1

1

-

1

1

0 Comments

Recommended Comments

There are no comments to display.