Hmight

-

Posts

258 -

Joined

-

Last visited

Content Type

Profiles

Blogs

Articles

Media Demo

Gallery

Downloads

Events

Forums

Posts posted by Hmight

-

-

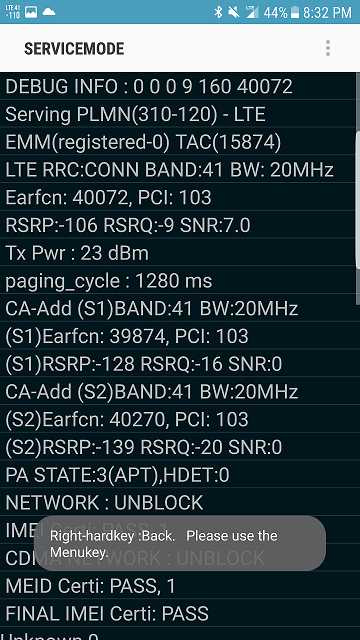

I am sitting in Wilkes-Barre and my phone is acting slow. Look at what it shows I am connected to.

How did you get the software upgrade on the S7 already?

-

I don't get why people are so obsessed about this merger going through. The bad far outweighs the good with this buyout/merger.

Because it's slow news day.

But this is why I am very optimistic with Sprint, with or without the merger. They have all the tools at their disposal (spectrum, increase cash flow, favorable regulatory environment for network build out), they just need to execute.

“Sprint management also expects to out-execute T-Mobile over the next two years, making a deal more attractive for them over time, but not in 2017.”

I do not believe the merger will happen between Sprint and Tmo. The feature is with a wireline and wireless. The synergy is tremendous when these organizations combine. T and VZ is already moving in that directions. T is much more aggressive.

-

1

1

-

-

You're getting ahead of yourself. Everything you're predicting is unrealistic. The only thing that can be guaranteed is At&ts network becoming slow and congested.

Amen!

-

I guess will deploy massive MIMO at some point or another. 64Tx64R. They showed off prototype Nokia antenna in NYC.

Delightful read

-

1

1

-

-

oh cool. thank you!

-

1

1

-

-

One thing I did notice on the image above, was that they had 3 devices running 3XCA, GS7, HTC Bolt and the iPhone 7.

Why can't they just release the software to those devices that are capable?

It makes me think Sprint is not ready to have 3xCA for customers. I mean this has been raved about for almost a year.

-

Sorry about that. It looks like I may have failed to hit the Save button after changing your status. You're good to go now.

Using Tapatalk on Note 8.0

I also donated may be a little bit over a week ago, but have not seen a change in my status.

-

Listening to John Saw right now, more details about band 41 uplink CA coming out in coming weeks.

I was curious about it too when I heard it. Does this mean there will be a software update soon? Hope they will this roll out the same time as 3xCA.

-

You should call up Sprint and Verizon and let them know advertising on TV is a huge waste of money because it does not allow for an immediate transaction and nobody changes providers anyway.

Also, WTF does Charmin keep advertising with those damn bears? Its toilet paper. We have no choice, we have to buy it.

Lol. you just proved why Charmin uses the "damn" bears in its ads. You know it's toilet paper and it's the damn Charmin bears.

-

1

1

-

-

52 week high @ 8.73. Hold?

Depends on what you think the future holds for Sprint.

I am an optimist and I think this is just the beginning of the ride. I won't consider selling at least until after Trump is in office.

-

I wouldn't be shocked if a few months from now a announcement is made.

Sent from my iPhone using Tapatalk

I hope not, and Masa has said after the announcement that the money is to invest in U.S start ups. It's always been his bread and butter.

-

Just like that..50 billion and 50k jobs tweet from Trump, the stock is now at $8.4. This is just the beginning of the ride. Still wish for another pull back down to $7 for me to buy more.

-

On the webcast, the CFO just said that Sprint stopped leasing Android phones because they weren't holding their value.

it was not obvious?

-

1

1

-

-

I think it has to hold at or above $8 for a certain period of time I believe.

Sent from my iPhone using Tapatalk

Yep

The 10 million shares will only be earned "upon the achievement of specified volume-weighted average prices" of Sprint's common stock during regular trading on the New York Stock Exchange over any 150-calendar day period during a four-year period from June 1, 2015, through May 31, 2019. In order to earn 100 percent of the 10 million shares, the volume-weighted average price must be at least $8 during that period. If the volume-weighted average stock price during the period goes above $8, Claure could earn more stock, but no more than 120 percent of the original award.

Source -

-

2

2

-

-

I just sold some more shares at $7.97

I reiterate my position of hype wariness and believe the stock will get hit negatively by the Federal Reserve raising interest rates in December.

We have different philosophy, but here's my 2 cents.

Sprint has gotten off the bonds market to finance. Softbank has essentially been financed (or guaranteed) Sprint's debt with various entities (leasing and spectrum Co.). As long as the company is growing, I am not concerned about the 30B+ in debt with a Sprint's strong balance sheets.

Raising interest rates will have little impact on Sprint in December.

-

2

2

-

-

$8 this morning. Time to sell or hold?

I'm riding this. There will not be any news of merger until at least 1st quarter of next year. Sprint is going to add phone subs again this quarter. They are going to pay off 2B of debt on 12.1.2016. Nothing negative for me to sell.

-

1

1

-

-

I have not sold off any shares, but wish the stock takes a 10% dip so i can buy more before the next earnings call.

7.89 price at the moment.

-

1

1

-

-

There isnt one. Kevin Crull from midwest was covering but as of today Sprint is going to 2 areas instead of 4 and Jaime Jones is heading up the east.

Sent from my LG-LS997 using Tapatalk

Will there be a press release on this?

-

The gains are pure speculation.

Any "disruption to the norm" in Washington is always met with gains and losses.

The ATT/TW tie up's fate will set the tone going forward. If there are post election undercurrents about that being denied, its never too soon to sell your S stock.

There's definitely speculation baked in, but the company's recent performance has not been accounted in the stock since the last earnings release. It was already at 7 dollars before Trump was elected. Anything between 7 and 8 is reasonable at this point. Anything more than 8, there's room for a sell off until the next earnings announcement.

Trump has already said T and TW will yield too much power. We will see if his administration will follow through.

-

1

1

-

-

It is.

Sent from my Nexus 5X using Tapatalk

Any guess when those who have 3xCA phones get our software upgrade?

-

Pay off debt with what? They continue to generate losses each quarter, not profits.

Sprint's current strategy (survival) is to keep finding different ways to replace old debt with new debt, ideally at a lower interest rates.

I like the stock long term. The company is still bleeding cash, but they are gaining valuable customers. I do not see this trend is reversing as long as Marcelo is at the helm. They have beefed up their balance sheets and have pulled a few financial engineering moves (thanks to Softbank) to get to where they are today. I am seeing 3rd carrier roll out in markets they have not even announced. This will improve the speed on the network, and capacity with their densification plan. They are in the same position of Tmo was a year and half ago. I expect growth will continue this quarter (around 450k postpaid phones and potentially more tablet adds with the new unlimited plan).

I expect FCF will be a reality in FY 2017. A merger or not, Sprint is in a good spot. It is still cheap to buy and I will buy more when it is taking a 10%+ dip.

-

Sprint is trading over $7. who bought it at $6? I guess good news for merger?

The trading is definitely pricing into a merger. It has nowhere to go but up. Any news of a merger or the company is gaining more subscriber this quarter we will see another pop.

-

1

1

-

-

As far as I've heard, his potential attitude toward such a merger is a total wildcard. You'd think that given his party he would be in favor, but both companies are foreigner-controlled which would probably influence his decision. How much? Not sure.

Republican tend to be more free deal willing. Sprint stock is doing well this morning because of this "potential" merger.

-

But in this scenario, it is testing the stadiums during a major game.

and noone on Sprint uses Okhla speedtests, which comes to show the data is selective and biased. The random data is not controlled data, there are a million plausible reasons to say the data is not accurate.

Marcelo Claure, Town Hall Meetings, New Family Share Pack Plan, Unlimited Individual Plan, Discussion Thread

in General Topics

Posted

Very nice!!